Are you currently experiencing any of the following?

- Maintaining separate depreciation book schedules for each state

- Reading and rereading individual state tax guides

- Manually performing calculations for each state in a spreadsheet

- Being charged excessive fees by outside accountants to generate the necessary information for every state

Bassets eDepreciation now includes a state depreciation option that simplifies this complicated procedure to comply with unique depreciation requirements of every state, Forty-six states and the District of Columbia require an annual business income tax filing with the following breakdown:

- 5 states follow federal depreciation regulations

- 11 states follow the federal depreciation regulations, but disallow the current federal bonus depreciation regulations

- 31 states require depreciation to be calculated based upon their own unique depreciation regulations

Generally speaking, these state taxing authorities start with the federal tax form 1120’s Net Taxable Income. For the 42 states that either do not allow federal bonus depreciation or have their own unique depreciation regulations, adjustments for the disallowed federal depreciation are added back to the federal Net Taxable Income amount to arrive at an “adjusted” federal Net Taxable Income amount.

The tax preparer has to calculate depreciation based upon federal regulations without the current bonus depreciation deduction or based upon the individual state’s depreciation regulations. This state depreciation amount is then subtracted from the “adjusted” federal Net Taxable Income amount as described above. This “Adjusted” federal Net Taxable Income would now be the starting income amount for the state income tax calculations.

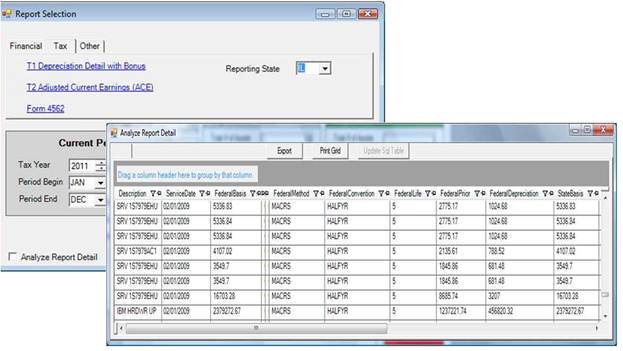

Bassets eDepreciation State module will use the existing Tax properties (purchase price, depreciation method, first year convention, service date, recovery periods) of each asset to calculate the required state numbers. Additional schedules are not required because the state module will process each asset against the detailed rules for the selected state, Both federal and state numbers are generated in detail for each asset that can be easily exported to Excel for further analysis. Additionally a summary schedule is compiled with totals needed for any state reporting forms.

For more information [click here]

445 Accounting | Construction in Progress | Expense Allocation | Foreign Currency Conversion | G/L Interface |

Lease Asset Tracker | Units of Production | A/P Import | Barcode Asset Inventory Control | State Tax Reporting

|